The Presidency has faulted the World Bank’s latest economic report, which estimated that about 139 million Nigerians are living in poverty, describing the figure as exaggerated and disconnected from the country’s prevailing realities.

LEADING REPORTERS gathered that the new figure by the organisation represents an increase from 129 million in April 2025.

President Bola Tinubu’s Special Adviser on Media and Public Communication, Sunday Dare, in a statement posted on his official X handle on Wednesday, said the World Bank’s poverty estimate must be “properly contextualised” within the framework of global poverty measurement models.

“While Nigeria values its partnership with the World Bank and appreciates its contributions to policy analysis, the figure quoted must be properly contextualised. It is unrealistic,” Dare said.

According to the Presidency, the global lender’s estimate was based on the $2.15 per person per day international poverty line, set in 2017 using Purchasing Power Parity (PPP). It said the figure should not be mistaken for an actual headcount of poor Nigerians.

The statement explained that, when converted to nominal terms, the $2.15 benchmark equals about N100,000 per month at the current exchange rate, which is significantly higher than Nigeria’s new minimum wage of N70,000.

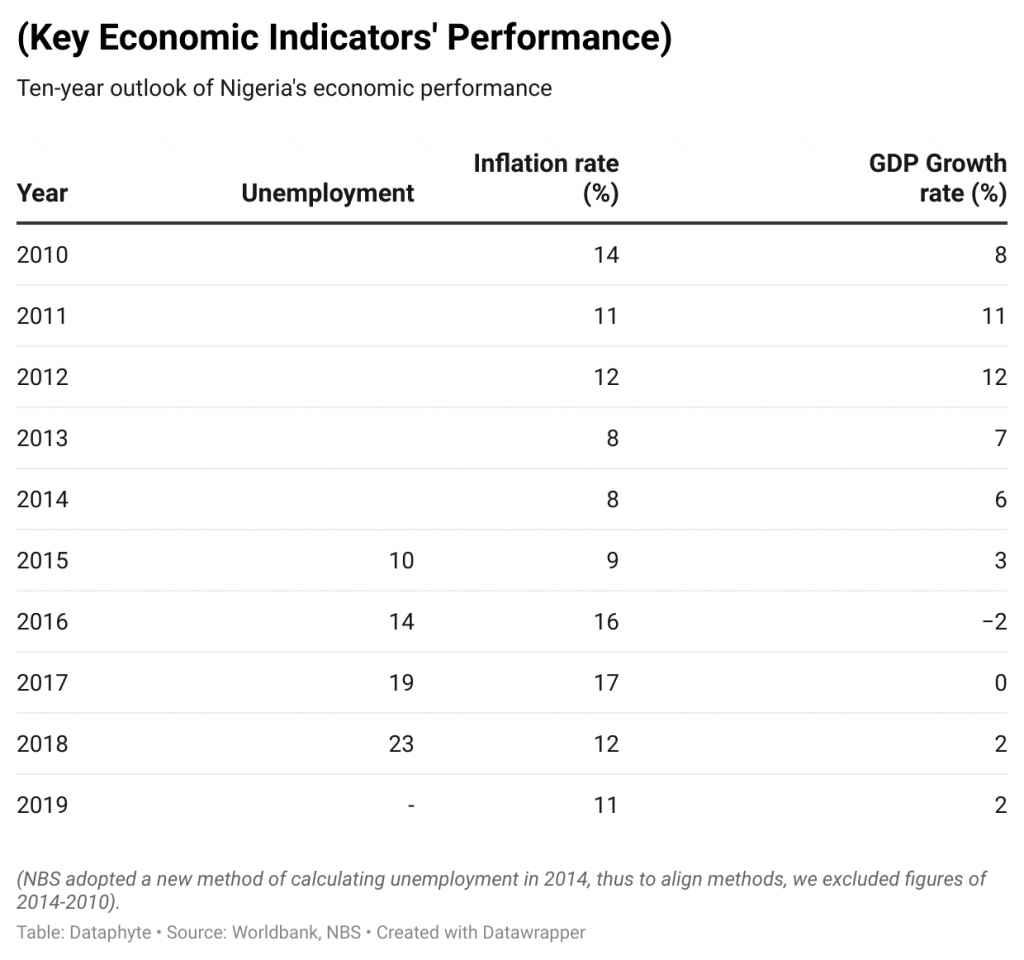

It added that the PPP methodology relies on historical consumption data—Nigeria’s last major household survey was conducted in 2018/2019—and often fails to account for the large informal and subsistence sectors that sustain millions of Nigerian families.

“There must be caution against interpreting the World Bank’s numbers as a literal, real-time headcount,” the Presidency said. “The figure is an analytical construct, not a direct reflection of local income realities.”

The Presidency, therefore, described the World Bank’s estimate as a modelled global projection rather than an empirical reflection of living conditions in 2025.

Dare stressed that the administration’s focus was on changing the trajectory, not debating static figures, adding that Nigeria’s economy was now on a recovery and reform path aimed at achieving inclusive growth and social protection.

He noted that the administration has expanded a number of social welfare and economic initiatives under the Renewed Hope Agenda to cushion the impact of recent reforms while laying the foundation for long-term prosperity.

These, he said, include the Conditional Cash Transfer programme, which now covers 15 million households nationwide with digital verification through the National Social Register; the Renewed Hope Ward Development Programme targeting all 8,809 electoral wards with micro-infrastructure and social projects; and the strengthening of National Social Investment Programmes such as N-Power, GEEP micro-loans, and school feeding schemes to support jobs, businesses, and education.

He further cited food security initiatives involving the distribution of subsidised grains and fertilisers, mechanisation partnerships, and the revival of strategic food reserves to stabilise staple prices.

The Renewed Hope Infrastructure Fund, he said, is financing key road, housing, and power projects to lower living costs and create jobs, while the National Credit Guarantee Company is expanding affordable credit access for small businesses, women, and youth entrepreneurs through risk-sharing arrangements with commercial banks.

The Presidency maintained that the Tinubu administration was tackling Nigeria’s poverty challenge by addressing the structural distortions that have constrained productivity and inclusive growth for decades.

It explained that ongoing reforms such as the removal of fuel subsidy, exchange rate unification, and fiscal reallocation of funds toward productive sectors were “painful but necessary choices” aimed at fixing the root causes of poverty rather than its symptoms.

It noted that even the World Bank had acknowledged that these reforms are already restoring macroeconomic stability and growth momentum.

The government emphasised that economic recovery alone is not enough unless it translates into real welfare gains for ordinary Nigerians. According to the statement, the administration’s medium-term priority is to ensure that macroeconomic stability leads to affordable food, quality jobs, and reliable infrastructure.

It added that major investments were underway in agriculture, manufacturing, and power, including new gas-to-power projects and skill development hubs expected to boost job creation and reduce living costs. “Nigerians should begin to feel visible improvements in food prices, income, and purchasing power as these programmes mature,” the statement said.

The Presidency also revealed that efforts were ongoing to consolidate the nation’s social protection architecture under a unified, data-driven framework to enhance transparency and ensure that no vulnerable community is left behind. It said the administration was expanding the National Social Register and scaling up existing social investment schemes to provide targeted support to poor households.

The Presidency reaffirmed President Tinubu’s commitment to building a resilient and inclusive economy that directly improves living standards. “Nigeria rejects exaggerated statistical interpretations detached from local realities. The government remains focused on empowering households, expanding opportunity, and laying the foundation for a fairer, more prosperous nation,” the statement said.