Tinubu Appoints Jim Obazee, EX-FRCN Boss Who Almost Sacked Pastor Adeboye From RCCG To Probe CBN

President Bola Tinubu has appointed a Special Investigator to probe the Central Bank of Nigeria (CBN) and Related Entities.

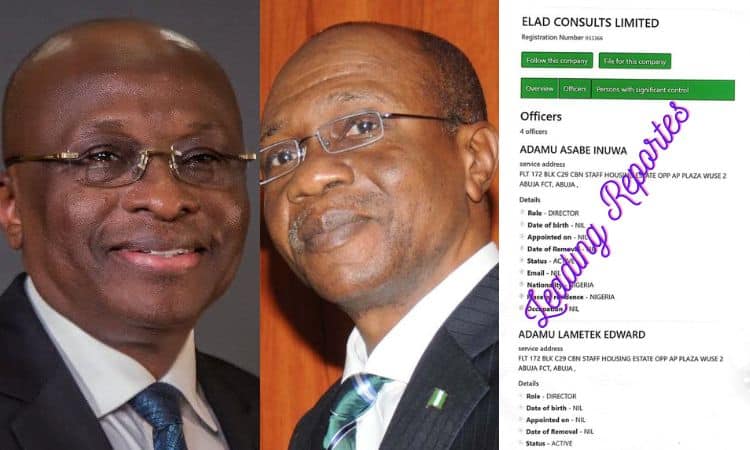

In a letter sighted by Leading Reporters, the president named Jim Osayande Obazee, the Chief Executive Officer, Financial Reporting Council of Nigeria (FRCN), as the investigator.

The President asked the Special Investigator to investigate CBN and key Government Business Entities (GBEs).

He also said Obazee would report directly to his office.

“In accordance with the fundamental objective set forth in Section 15(5) of the Constitution of the Federal Republic of Nigeria 1999 (as amended), this administration is, today, continuing the fight against corruption by appointing you as a Special Investigator, to investigate the CBN and Related Entities. This appointment shall be with immediate effect and you are to report directly to my office.”

“The full terms of your engagement as Special Investigator shall be communicated to you in due course but, require that you immediately take steps to ensure the strengthening and probity of key Government Business Entities (GBEs), further block leakages in CBN and related GBEs and provide a comprehensive report on public wealth currently in the hands of corrupt individuals and establishments (whether private or public).

“You are to investigate the CBN and related entities using a suitably experienced, competent and capable team and work with relevant security and anti-corruption agencies to deliver on this assignment. I shall expect a weekly briefing on the progress being made,” the letter read.

The president also sent a copy of his directive suspending Godwin Emefiele as Governor of the CBN on June 9, 2023.

Emefiele has been in DSS custody since then. He was arraigned in court last week and granted bail but the secret police rearrested him.

Obazee had in the past led major investigations Central Bank of Nigeria (CBN); Bank of Industry (BOI); Zenith Bank of Nigeria Plc; Guaranty Trust Bank Plc and Access Bank Plc.

He has also participated in 16 technical committees including 1. Technical Committee on Accounting in the Petroleum Industry – Upstream Activities; Technical Committee on Accounting for Insurance Business; Technical Committee on Accounting for Statement of Cash Flows; Committee on Implementation Guide to Accounting for Leases and Technical Committee on Accounting in the Petroleum Industry – Downstream Activities among others.

Recall that Obazee, in connection with the implementation of the controversial corporate Governance Code 2016 made the headlines when Pastor Enoch Adeboye relinquished his position as the General Overseer of RCCG and announced Pastor Joseph Obayemi as the new overseer of the church.

The code limits the tenure for heads of religious groups and civil rights organisations to 20 years. He pushed for the implementation against Buhari’s wish.