The Federal Government (FG) has borrowed N17.36 trillion from domestic and foreign sources in the first 10 months of 2025, N6.06 trillion (55.6%) above the prorated N10.9 trillion borrowing limit set in the 2025 Appropriation Act.

Domestic borrowing hit N15.8 trillion by October, while external loans reached N1.56 trillion in the first half.

An additional $2.35 billion (N3.384 trillion) Eurobond issuance, initiated last week, will push total borrowing to N20.74 trillion.

Projections based on current trends estimate full-year borrowing at nearly N23 trillion, N10 trillion (80%) over the N13.08 trillion annual budget ceiling.

The 2025 budget projected N54.99 trillion in expenditure against N41.91 trillion in revenue, leaving a N13.08 trillion deficit to be financed through borrowing.

Breakdown of Domestic Borrowing (Jan–Oct 2025):

Treasury Bills: N11.43tn (+4.6% YoY)

FGN Bonds: N4.042tn (-22% YoY)

FGN Savings Bonds: N40.19bn (+5.6% YoY)

Sukuk Bonds: N300bn (from zero in 2024)

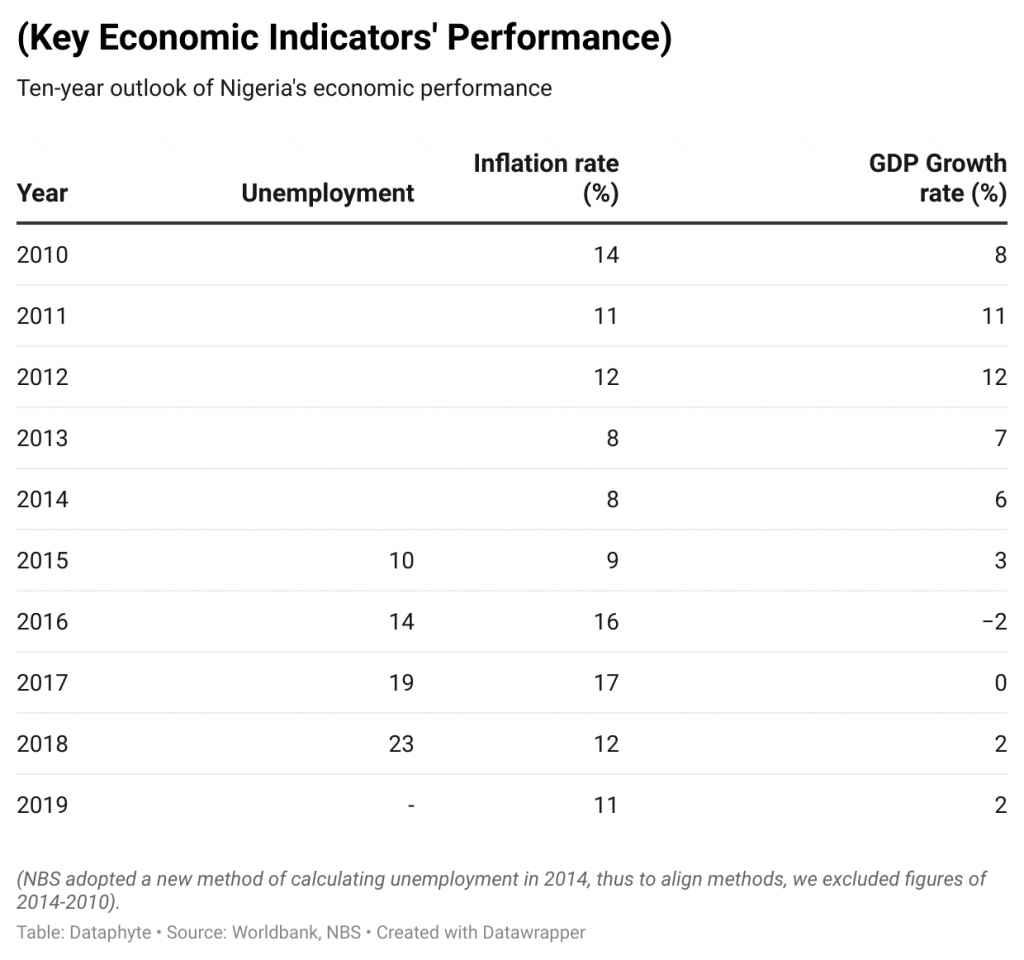

Financial analysts warn that persistent overshooting amid weak revenue performance risks a debt trap, crowds out private sector credit, and undermines IMF-backed fiscal reforms.

Andrew Uviase, Managing Partner at Ecovis OUC, called it “a clear reflection of fiscal indiscipline and poor expenditure control,” urging drastic cuts in governance costs and improved transparency.

He noted that despite FIRS gains, non-oil revenue remains disappointing, fueling reliance on borrowing.