The Managing Director/Chief Executive Officer of the Nigeria Social Insurance Trust Fund (NSITF) Oluwaseun Mayomi Faleye, is accused of operating more than 100 bank accounts linked to a single Bank Verification Number (BVN) and granting himself “unlimited spending powers” to siphon and misappropriate funds belonging to Nigerian workers.

Multiple internal documents, bank records, and testimonies obtained by allege that Faleye unilaterally conferred these powers on himself and authorised the disbursement of hundreds of billions of naira belonging exclusively to Nigerian workers, without lawful approval, board oversight, or adherence to federal financial regulations.

₦297 Billion Workers’ Funds, ₦243 Billion Allegedly Spent Without Approval

According to documents reviewed by US, between January 2 and October 9, 2025, the NSITF recorded total lodgments of ₦297,019,145,288.60.

The funds, insiders stressed, were derived entirely from compulsory employer contributions under the Employees’ Compensation Act (ECA), a statutory scheme designed to protect Nigerian workers injured, disabled, or killed in the course of employment.

Within the same period, records show that ₦243,203,518,621.17 was spent. Multiple senior officials alleged that a significant portion of this expenditure was carried out without the approval of the NSITF Management Board, in violation of the Act establishing the Fund and existing federal financial regulations.

“This is not government money. This is workers’ money, contributed mandatorily under the law,” one senior NSITF official said.

“Every kobo is supposed to be protected by layers of checks and balances. What we are seeing here is a complete collapse of those safeguards.”

‘No Approval Limit’: How Faleye Allegedly Gave Himself Unchecked Spending Powers

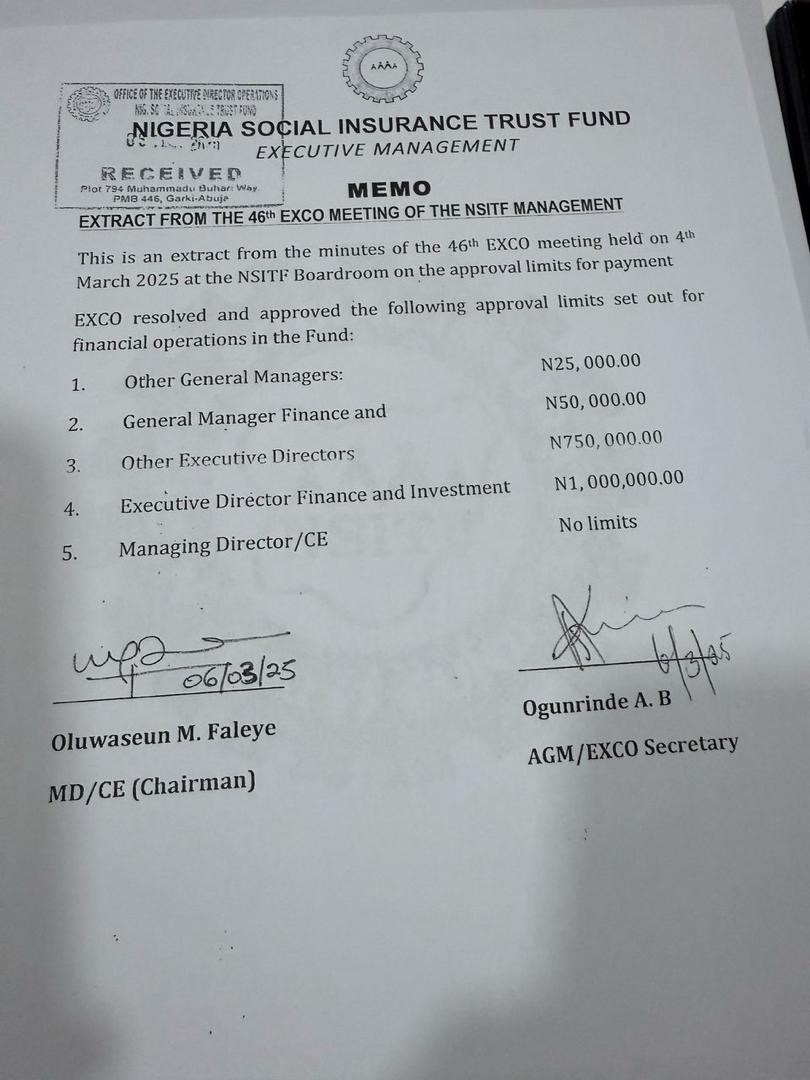

Central to the allegations is a document dated March 4, 2025, signed by Mr. Faleye and obtained by .

The document is an extract from the minutes of the 46th Executive Committee (EXCO) meeting held at the NSITF Boardroom, and chaired by Faleye, detailing approval limits for financial transactions within the Fund.

According to a document obtained by US, the EXCO resolution set clear limits for other officials: other general managers, ₦25,000; General Manager (Finance), ₦50,000; other executive directors, ₦750,000; and the Executive Director (Finance and Investment), ₦1,000,000.

However, under the same resolution, the Managing Director/Chief Executive Officer, Mr. Faleye, and the chairman, approved no limit for his own spending authority.

According to multiple sources, this effectively gave Mr. Faleye unrestricted power to approve payments of any amount, without recourse to the Management Board or external oversight.

“He simply wrote and signed a document granting himself ‘No Approval Limit’,” a senior official disclosed. “There is absolutely no legal basis for this in the NSITF Act or in federal financial regulations.”

Another insider added, “This amounts to usurping the powers of the President of the Federal Republic of Nigeria. Under existing rules, even Managing Directors of parastatals are capped. They cannot wake up and approve unlimited spending.”

Current federal thresholds reportedly allow Managing Directors to approve up to ₦30 million for works and ₦10 million for goods and services, and even those approvals remain subject to board oversight.

“What happened here defies every known rule of public finance management,” a source said.

Several NSITF insiders described deep distress over the alleged abuses.

“This is the most reckless abuse of power I have witnessed in over 20 years in the public sector,” a senior official told Our Reporters.

“He effectively sidelined the Board, ignored the law, and treated workers’ funds as personal cash. The emotional toll of witnessing this level of corruption is enormous. I can’t even sleep.”

Millions of Dollars Allegedly Traced to Faleye, Linked Entities

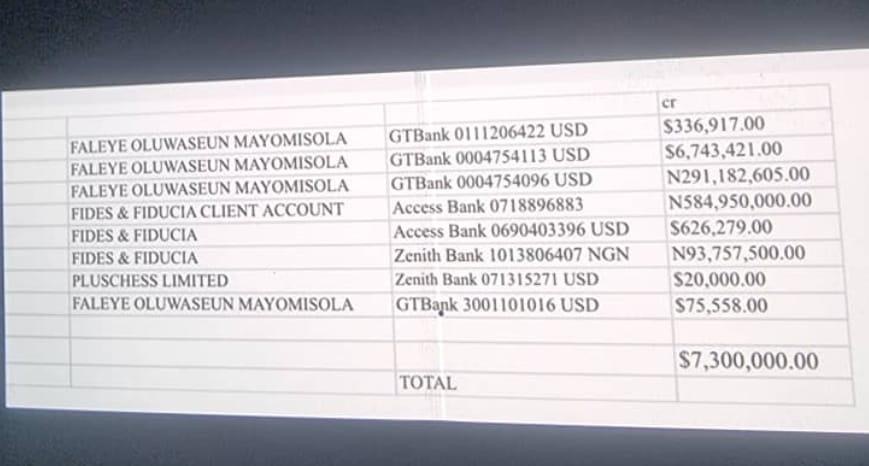

In a separate document exclusively obtained by SaharaReporters, investigators traced alleged inflows of millions of dollars and hundreds of millions of naira into bank accounts linked directly to Mr. Faleye and entities reportedly associated with him.

The transactions listed include: Faleye Oluwaseun Mayomisola, GTBank USD Account 0111206422 – $336,917.00

Faleye Oluwaseun Mayomisola, GTBank USD Account 0004754113 – $6,743,421.00

Faleye Oluwaseun Mayomisola, GTBank NGN Account 0004754096 – ₦291,182,605.00

Fides & Fiducia Client Account, Access Bank NGN Account 0718896883 – ₦584,950,000.00

Fides & Fiducia, Access Bank USD Account 0690403396 – $626,279.00

Fides & Fiducia, Zenith Bank NGN Account 1013806407 – ₦93,757,500.00

Pluschess Limited, Zenith Bank USD Account 071315271 – $20,000.00

Faleye Oluwaseun Mayomisola, GTBank USD Account 3001101016 – $75,558.00

The total dollar inflow alone is estimated at over $7.3 million, excluding naira-denominated transactions.

“These are not small transfers. The volume, frequency, and structuring suggest deliberate efforts to move and possibly conceal funds,” a source familiar with the documents said.

Over 100 Bank Accounts, One BVN

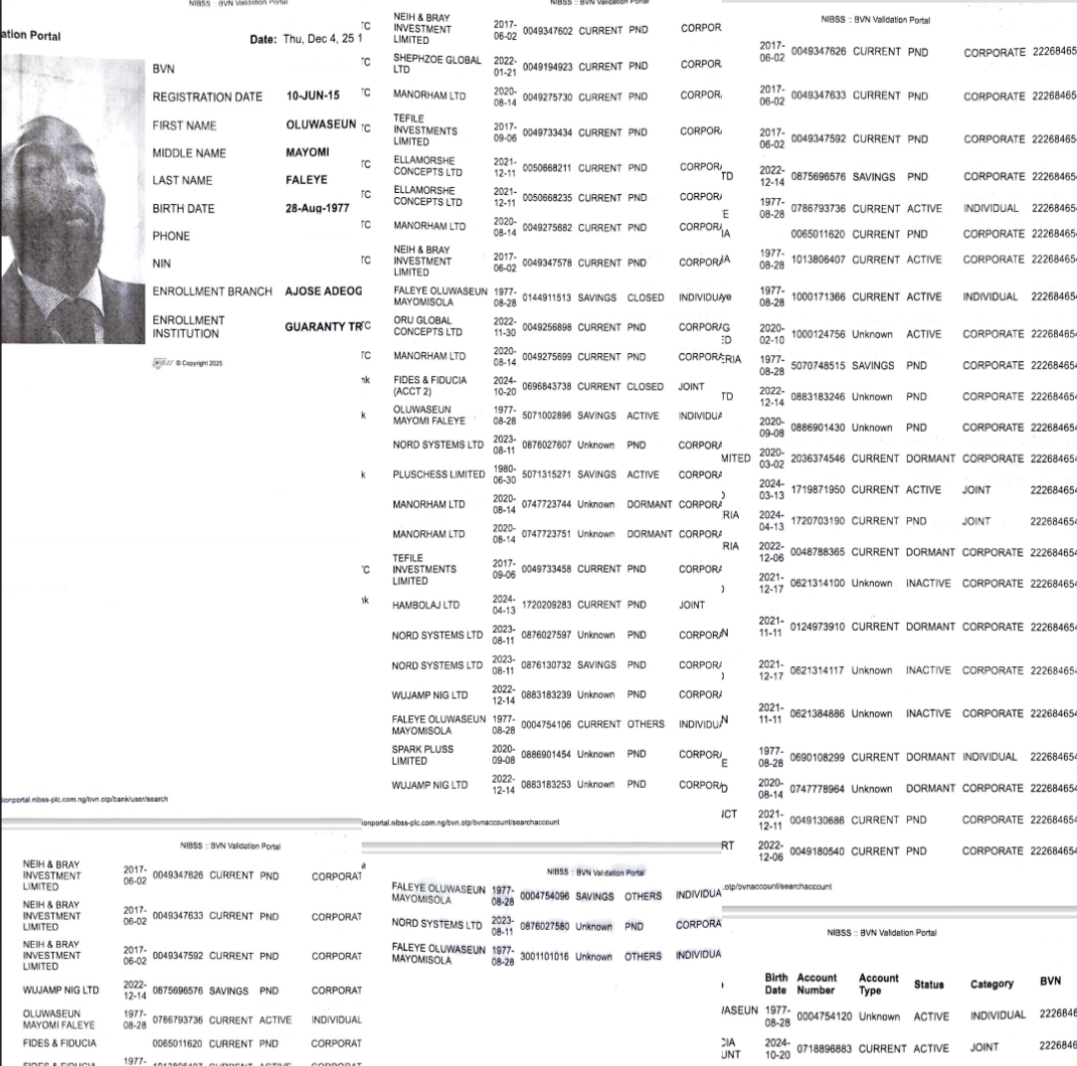

Perhaps most alarming is another document obtained by US, which reportedly shows more than 100 active bank accounts linked to a single BVN belonging to Mr. Faleye.

The BVN profile details are as follows: The registration date is June 10, 2015. The first name is Oluwaseun, the middle name is Mayomi, and the last name is Faleye.

The date of birth is August 28, 1977. The enrollment bank is Guaranty Trust Bank, and the enrollment branch is Ajose Adeogun.

Sources allege that many of these accounts received funds traceable to NSITF operations.

“The scale is staggering,” one insider said. “You don’t run over 100 accounts accidentally. This points to systematic structuring.”

‘₦5.5 Billion Commission Payments Approved Without Board or Ministry’

Beyond personal accounts, sources allege that Mr. Faleye authorised speculative commission payments totalling over ₦5.53 billion without approval from either the NSITF Management Board or the Ministry of Labour.

The payments, allegedly ranging between 15% and 20% commission, include: “09/10/2025, Assurance Services ST ADBA Ltd: ₦1,379,186,010.00, 18/03/2025, TAGG Global Resources Ltd: ₦865,000,000.00, 17/09/2025, Rate Seal Support & Project Ltd: ₦683,777,666.40, 16/05/2025, Rate Seal Support & Project Ltd: ₦659,303,810.50.

“16/05/2025, Rate Gold Solution Nig Ltd: ₦648,750,000.00, 01/08/2025, Gold Solution Nig Ltd: ₦648,750,000.00, 01/08/2025, TAGG Global Resources Ltd: ₦648,750,000.00, Total: ₦5,533,517,486.90.

“This money was approved and paid without lawful authority,” a source said. “No board resolution. No ministerial approval.”

Board Absence and Alleged Exploitation of Governance Gap

Sources further disclosed that Mr. Faleye was appointed Managing Director in July 2023, while the NSITF Management Board was not constituted until around January 2025, a gap of more than one year.

“NSITF is not meant to operate without a board,” a top official explained.

“The Act expressly forbids Executive Management from spending funds without board approval. If there is no board, spending should not take place.”

Although the Ministry of Labour has historically attempted to fill temporary governance gaps, insiders insist this does not override the law.

“At no point has Executive Management been allowed to approve financial transactions for itself,” a source said.

“What happened here is unprecedented. This is not mismanagement. It is misappropriation and outright theft.”

‘This Is Workers’ Money, Not National Cake’

Multiple officials emphasised that NSITF funds are distinct from regular government revenue.

“Government contributes nothing except as an employer like everyone else,” one source said.

“Under the law, every employer pays one percent of payroll. The money belongs to Nigerian workers, not the government.”

However, to safeguard this fund, the Act established a strict tripartite governance structure. This structure involves three key stakeholders: the Nigeria Employers’ Consultative Association (NECA), the Nigeria Labour Congress (NLC), and the Federal Ministry of Labour.

“These stakeholders jointly crafted the law,” a source said. “The structure was deliberately designed to prevent exactly this kind of abuse.”

When we contacted the NSITF Chief Executive Officer, Faleye, he said he was not aware of the allegations.

However, when asked about the dollar account and how $7.3 million was allegedly transferred into it, he abruptly hung up the call.

Efforts to get him to respond to the allegations afterward were unsuccessful.

We also reached out to the Permanent Secretary of the Ministry of Labour, Salihu Usman, to ask whether they approved a ₦5 billion commissioning project and how ₦240 billion was allegedly mismanaged.

He denied being aware of the allegations.

When we contacted the Chairman of the NSITF Board, Shola Olofin, he said, “Please give me time to verify this information and claims.”

News credit: saharareporters.com